Land Loans

Stake your claim.

- 15-year fixed-rate loan

- Max loan amount $300,000

- Max LTV 65%

Buy Land Now and Build Your Home Later.

If you've found the perfect piece of land for your future home but aren't quite ready to begin construction, Land Loans, also known as Lot Loans, give you the opportunity to secure the land you want now without a timeline to build.

Ready to start building? Check out our Construction Loan Program.

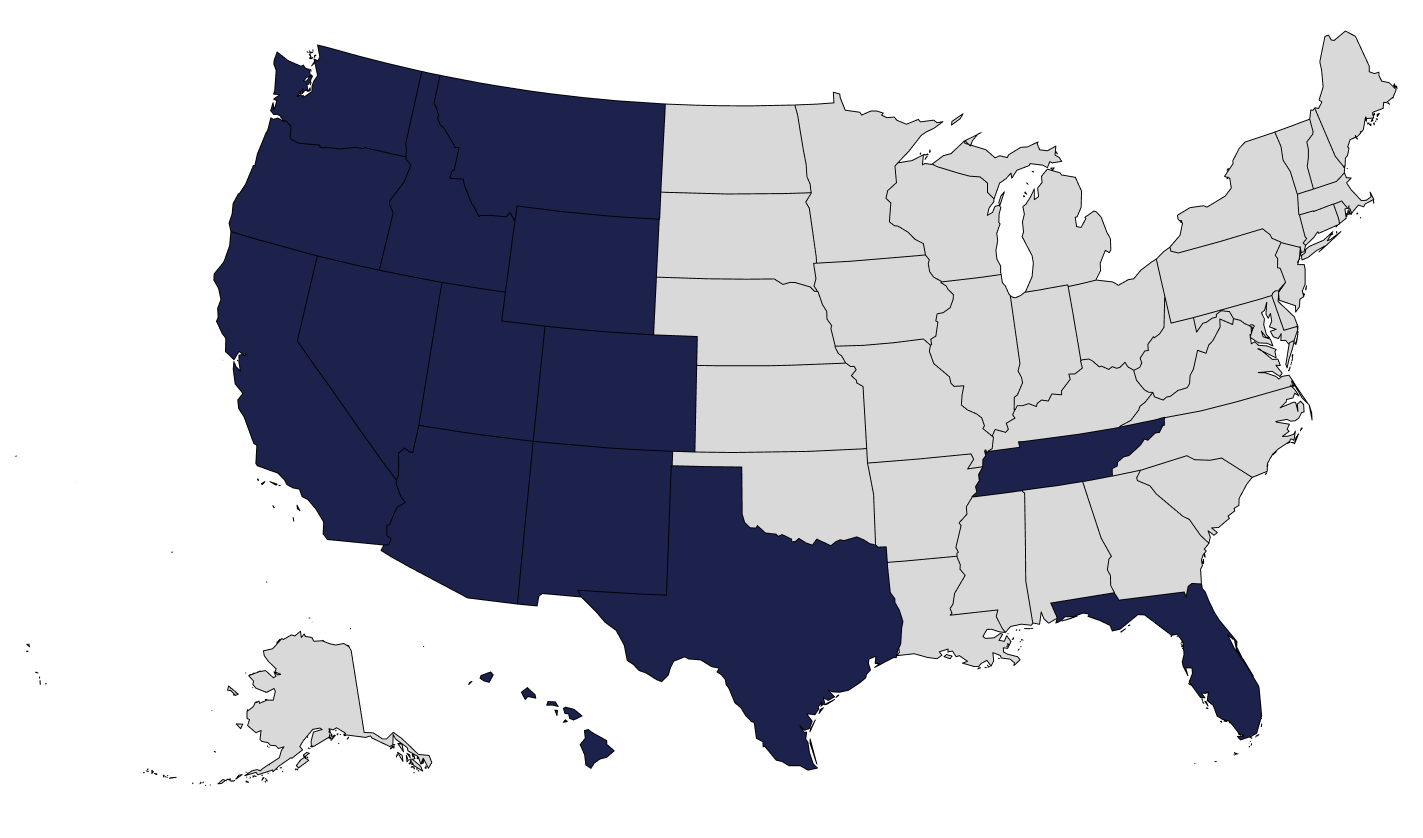

What States Are Land Loans Available In?

- Arizona

- California

- Colorado

- Florida

- Hawaii

- Idaho

- Montana

- Nevada

- New Mexico

- Oregon

- Tennessee

- Texas

- Utah

- Washington

Getting Started

It's important to examine the soil to see how well it drains. Poor drainage can make building a foundation and setting up a septic system more challenging.

Certain plots of land might not be fully developed, and you may need to make improvements such as adding roads, power lines, and water supply. These upgrades can get costly, so it's important to keep your budget in check.

While the land may seem perfect, it's important to be aware of potential zoning restrictions imposed by the city or town, which could hinder your construction plans.

When considering the purchase of land within a subdivision, it's essential to explore the neighborhood's specific regulations. These guidelines cover aspects like architectural style, setback requirements from the road, parking allowances, and more.

Think about easements and access rights, which are agreements between neighbors allowing access to parts of their land for things like reaching waterfronts, roads, electricity, and more. It's important to know if the property you're interested in, or its neighboring properties, have any access agreements in place.

A survey will determine and validate the boundary lines of the property and what improvements may need to be made before a home can be built.

![]()

Buying Land & Building?

We offer construction loans to help you build your dream home.

Land Loan Contact Form

Subject to credit approval.

* Participation in this program will not be confirmed until the completed application has been submitted to the Real Estate Department. All requests will be processed and must meet Firefighters First's underwriting guidelines. Funding of these loans is subject to credit approval and verification of employment, equity, and all other related file documentation necessary to qualify applicant(s).

Taxes and insurance premiums are not included in the payment and that the actual payment obligation may be greater.

APR = Annual percentage Rate.

Representative Example: 15 year fixed land loan: 8.25% rate, 8.689% APR $250k loan amount, $2,425.35 payment. Taxes and insurance premiums are not included in the payment and that the actual payment obligation may be greater.